Solid Growth Momentum in the Games Business;

Education Business Gaining Further Traction with 33% QoQ Revenue Growth

(Hong Kong, June 23, 2016) NetDragon Websoft Holdings Limited (“NetDragon” or the “Company”; Hong Kong Stock Code: 777), a global leader in building internet communities, today announced its financial results for the first quarter ended March 31, 2016.

NetDragon’s management team will hold a conference call and webcast at 8 p.m. Hong Kong time on June 23 to discuss Q1 results and recent business developments.

2016 First Quarter Financial Highlights

- Revenue was RMB571.6 million: 14.2% increase quarter-over-quarter; and 132.2% increase year-over-year

- Revenue from the games business was RMB284.1 million: 0.3% increase quarter-over-quarter; and 26.6% increase year-over-year

- Revenue from the education business was RMB279.9 million: 33.4% increase quarter-over-quarter; and 2,704.5% increase year-over-year

- Gross profit was RMB346.4 million: 10.9% increase quarter-over-quarter; 67.2% increase year-over-year

- Adjusted segmental profit1 from the games business was RMB107.4 million: 5.5% increase quarter-over-quarter; and 153.4% increase year-over-year

- Adjusted segmental loss1 from the education business was RMB146.5 million: 12.3% increase quarter-over-quarter; and 728.4% increase year-over-year

- Non-GAAP2 operating loss was RMB111.8 million which includes an operating loss3 of RMB 59.5 million from Promethean which is expected as first quarter is a traditional off-season for education business, together with a net exchange loss of RMB20.7 million which is predominantly attributed to currency fluctuation exchange and is unrelated to the core operational performance of the business

- Going into the second quarter, which is the peak season in the international education markets, the Company expects a significant uptick in both top and bottom line

2016 First Quarter Gaming Operational Metrics

- Average Concurrent Users (“ACU”) for online games was approximately 332,000, a 4.7% increase quarter-over-quarter and 7.4% increase year-over-year

- Peak Concurrent Users (“PCU”) for online games was approximately 748,000, a 0.5% decrease quarter-over-quarter and 6.4% increase year-over-year

- Monthly average revenue per user (“ARPU”) for online games was approximately RMB255, a 5.9% decrease quarter-over-quarter and 25.6% increase year-over-year

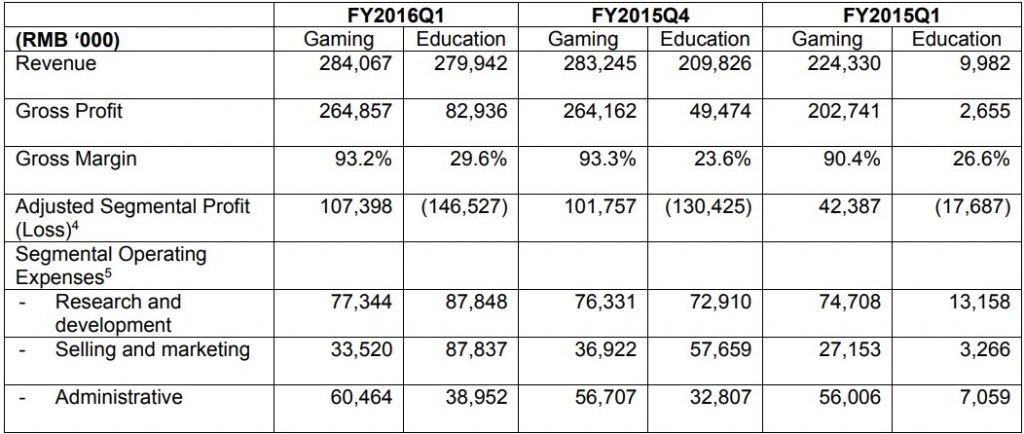

Segmental Financial Highlights

Note 1: Adjusted segmental profit/loss figures are derived from the Company’s reported segmental profit/loss figures (presented in accordance with Hong Kong Financial Reporting Standards) but exclude non-core/operating or non-recurring items including government grant, one-time write-back of reserve, fair value of change of financial assets, net gain on derivative financial instrument (related to Series A preferred shares of education subsidiary), and net loss on held-for-trading investments.

Note 2: See “Non-GAAP Financial Measures” section for more details on the reasons for presenting these measures.

Note 3: The above operating loss of RMB 59.5 million of Promethean excludes exchange loss which is grouped in the RMB 20.7million net consolidated exchange loss in the same bullet point above.

Note 4: Adjusted segmental profit/loss figures are derived from the Company’s reported segmental profit/loss figures (presented in accordance with Hong Kong Financial Reporting Standards) but exclude non-core/operating or non-recurring items including government grant, one-time write-back of reserve, fair value of change of financial assets, net gain on derivative financial instrument (related to Series A preferred shares of education subsidiary), and net loss on held-for-trading investments.

Note 5: Segmental operating expenses exclude unallocated expenses/income such as depreciation, amortization and exchange gain/loss that have been grouped into SG&A categories on the Company’s reported consolidated financial statements but cannot be allocated to specific business segments for purpose of calculating the segmental profit/loss figures in accordance with the Hong Kong Financial Reporting Standards.

Mr. Dejian Liu, Chairman and Executive Director of NetDragon, commented: “NetDragon recorded encouraging financial results during the quarter and further strengthened our market position in the games and education businesses. We continued to optimize our gaming portfolio with high-quality IP-based games. Calibur of Spirit and Eudemons Online Pocket version continued to be well received among our players and secured continuous growth in user base and monthly gross revenue. In addition, we are pleased with the remarkable 48.3% year-over-year revenue growth of Promethean to RMB279.5 million in the first quarter on a pro-forma basis, demonstrating initial success in our integration efforts and a solid start to our international expansion in the education business.”

“As we strive to be the leader of building Internet communities, we continue to invest heavily in products and technologies, and expand with focus in the education and gaming sectors. We recently completed the acquisition of cherrypicks alpha, which will bring world-class Augmented Reality (AR) technologies into our portfolio. We also announced a significant investment in and setting up of a joint venture with ARHT Media. Through this joint venture which will own the exclusive license to ARHT Media’s industry-leading hologram technologies in China and selected Asian markets, we expect to create great opportunities in the professional training market.”

Games Business

The Company continued to see strong growth momentum of the games business in the first quarter, with revenue recorded at RMB284.1 million, an increase of 26.6% year-over-year.

This solid performance was mainly attributable to the outstanding revenue contribution of Calibur of Spirit and the stable growth of Eudemons Online. In addition, various operational indicators continued to improve, with an increase of 6.4% year-over-year of PCU at approximately 748,000, an increase of 7.4% year-over-year of ACU at 332,000, and a 25.6% year-over-year increase of monthly ARPU to RMB255.

A series of promotional events and content updates pushed the operational indicators of Calibur of Spirit to record highs. The game’s monthly gross revenue reached RMB49.3 million in February, while DAU reached 1.7 million in March. Eudemons Online Pocket version launched new expansion packs during the period that drove its monthly gross revenue also to a record high during the quarter, giving a healthy boost to the Company’s revenue.

2016 will be an exciting year for the Company’s games business. The Company will continue to boost the participation of users by launching new versions of successful game titles, build a more diversified games portfolio and explore opportunities in the Virtual Reality (VR) space.

Riding on the success of Calibur of Spirit, the Company will continue to enhance the sporting nature of the game, launch the eagerly-awaited mobile version in the second half of the year, and expand overseas. Calibur of Spirit’s overseas version is currently available in Singapore, Malaysia, and Vietnam, and the Company has entered into licensing agreements in multiple markets including Hong Kong, Macau, Portugal, Spain, and several other countries.

Meanwhile, the Company is on track to release a brand new mobile game of Eudemons Online in the second half of 2016. In addition, the English version of Tiger Knight will also be released on Steam platform during the same period.

Education Business

Revenue from the education business of the Company was RMB279.9 million during the first quarter of 2016, an increase of 2704.5% year-over-year and an increase of 33.4% quarter-over-quarter. On a proforma basis, Promethean recorded a 29.2% increase in revenue quarter-over-quarter (accounting for three months from October to December 2015) while achieved a significant 48.3% growth year-over-year.

ClassFlowTM, the Company’s flagship cloud-based interactive K-12 (Kindergarten-to-Grade 12) software in the international markets, continued its growth in its user base with close to half a million registered users at the end of the first quarter, and the Company expects to grow in multiples from this foundational base during the year.

The first quarter marked a remarkable beginning of 2016 with the Company’s international education business growing at a record pace with market share gains in major markets around the world by Promethean’s education interactive flat panel, ActivPanelTM. Based on the Company’s estimates, ActivPanelTM, which works together with ClassFlowTM to create an unrivalled education and teaching experience, has become the number one product in the K-12 markets in the U.S., France, Italy and several other countries in terms of market share. The success in the market share penetration continues to pave the way for the build-out of the global learning community.

The Company has continued to make strong progress in its product development including expanding its capabilities of 101 Education PPT software, its flagship product in China that provides best-in-class lesson preparation and in-class lesson delivery functionalities combined with seamless access to its education resources library. This resource library features a broad range of high-quality education contents covering all major academic subjects in primary and secondary education in China. The Company is also on track in the development of its VR products including end-user applications such as the flagship VR editor which will come with a wide range of “scenarios” and access to what the Company targets to be the largest 3D resource library for VR learning purpose. In the international markets, the Company has released ClassFlowTM 4.0 which comes with enhanced interface and functionalities. With ClassFlowTM 4.0, teachers can create assignments and assessments for students to complete independently, or collaboratively in small groups, both inside and outside of class. ClassFlowTM 4.0 also gives teachers insight into student learning and progress through polling and rich interactive formative assessments, which enables teachers to adjust any lesson instantly in the moment of learning and to personalize instruction. ClassFlowTM can be deployed on a range of one-to-one devices (operating on Android, iOS and Windows platforms) to facilitate the flow of data between the teacher and students during a lesson.

Excluding Promethean, revenue from the education business was RMB14.6 million for the period, an increase of 46.3% compared to RMB10.0 million in the same period of last year. The first quarter is traditionally the slow sales quarter of the year for the education industry in China due to the Chinese New Year holidays and constraints of China’s funding system, hence delaying schools’ buying decisions. The Company continues to expect 2016 to be a year of significant revenue ramp-up of its education business in China as it begins to commercialize its products more broadly. Furthermore, the Company has received positive feedback from its pilot tests of its 101 Education PPT software. Such feedback includes ease of use, short learning curve, capability to produce high quality lessons, significant time saved in lesson preparation, as well as enhancement of classroom interactivity and students’ engagement.

Leveraging on the peak seasons for the education industry in the second and third quarter, the Company expects its education business to record substantial growth for the upcoming periods, both in China and internationally. The synergistic effect Promethean creates across international channels will also be eased in gradually. The Company will continue to invest heavily in the development of products, technologies and content in order to stay ahead of its competitors in the user experience and capabilities of its products. Meanwhile, the Company is on track in the integration effort of Promethean, including exploring synergies in all areas including products, technologies and market access, as well as enabling a cost structure that will provide the highest return on investment of the Company’s resources.

Management Conference Call

NetDragon will host a management conference call with PowerPoint presentation and webcast to review its first quarter results ended March 31, 2016 on June 23, 2016, at 8 p.m. Hong Kong time. Management attending the conference call includes Simon Leung, Vice Chairman and Executive Director; Ben Yam, Chief Financial Officer.

Details of the live conference call are as follows:

International Toll 65-6713-5090

US Toll Free 1-866-519-4004

Hong Kong Toll Free 800-906-601

China Toll Free (for fixed line users) 800-819-0121

China Toll Free (for mobile users) 400-620-8038

Passcode NetDragon

A live and archived webcast of the conference call will be available on the Investor Relations section of NetDragon’s website at http://www.netdragon.com/investor/ir-webcasts.shtml . Participants in the live webcast should visit the aforementioned website 10 minutes prior to the call, then click on the icon for “1Q 2016 Conference Call” and follow the registration instructions.

About NetDragon Websoft Holdings Limited

NetDragon Websoft Holdings Limited (HKSE: 0777) is a global leader in building internet communities. Established in 1999, NetDragon is a vertically integrated, cutting-edge R&D powerhouse with a highly successful track record which includes the development of flagship MMORPGs such as Eudemons Online and Conquer Online, China’s number one online gaming portal, 17173.com, and China’s most influential smartphone app store platform, 91 Wireless, which was sold to Baidu in 2013 in what was at the time the largest Internet M&A transaction in China. Being China’s pioneer in overseas expansion, NetDragon also directly operates a number of game titles in over 10 languages internationally since 2003. In recent years, NetDragon has emerged as a major player in the global online and mobile education space as it works to leverage its mobile Internet technologies and operational know-how to develop a game-changing education ecosystem. For more information, please visit www.netdragon.com.

For investor enquiries, please contact:

NetDragon Websoft Holdings Limited

Ms. Maggie Zhou

Senior Director of Investor Relations

Tel.: +852 2850 7266/ +86 591 8754 3120

Email: maggie@nd.com.cn; ndir@nd.com.cn

Website: www.nd.com.cn/ir