Record High Revenue Achieved in Q2

Fuelled by Dual Growth Engines in Games and Education Business

(Hong Kong, August 31, 2016) NetDragon Websoft Holdings Limited (“NetDragon” or the “Company”; Hong Kong Stock Code: 777), a global leader in building internet communities, today announced its financial results for the second quarter and the first half of 2016 ended June 30, 2016. NetDragon’s management team will hold a conference call and webcast at 6 p.m. Hong Kong time on August 31 to discuss the results and recent business developments.

2016 Second Quarter Financial Highlights

- Revenue was RMB786.9 million: 37.7% increase quarter-over-quarter; and 195.8% increase year-over-year.

- Revenue from the games business was RMB296.7 million: 4.4% increase quarter-over-quarter; and 24.2% increase year-over-year.

- Revenue from the education business was RMB480.1 million: 71.5% increase quarter-over-quarter; and over 34 times increase year-over-year.

- Gross profit was RMB437.4 million: 26.3% increase quarter-over-quarter; 96.1% increase year-over-year.

- Core segmental profit1 from the games business was RMB99.4 million: 5.3% increase quarter-over-quarter; and 55.8% increase year-over-year.

- Core segmental loss1 from the education business was RMB87.7 million: 34.3% decrease quarter-overquarter; and 122.7% increase year-over-year.

- Non-GAAP2 operating profit was RMB28.1 million as compared to non-GAAP operating loss of RMB111.8 million for the first quarter. Such turnaround was mainly attributable to a combination of very strong performance of our international online education business as reflected in Promethean’s positive operating profit during the quarter, as well as continuous profitability growth in the games business.

- Net profit attributable to owners of the Company was RMB70.7 million as compared to net loss attributable to owners of the Company of RMB113.6 million in the first quarter.

2016 First Half Financial Highlights

- Revenue was RMB1,358.5 million: 165.2% increase year-over-year.

- Revenue from the games business was RMB580.8 million: 25.4% increase year-over-year.

- Revenue from the education business was RMB760.0 million: 3,141.3% increase year-over-year

- Gross profit was RMB783.9 million: 82.2% increase year-over-year.

- Core segmental profit1 from the games business was RMB193.7 million: 82.5% increase year-over-year.

- Core segmental loss1 from the education business was RMB221.1million: 287.6% increase year-over-year. The company declared an interim dividend of HK$ 0.10 per share for the six months ended 30 June 2016.

2016 Second Quarter Gaming Operational Metrics

- Average Concurrent Users (“ACU”) for online games was approximately 347,000, a 4.5% increase quarter-over-quarter and 9.1% increase year-over-year.

- Peak Concurrent Users (“PCU”) for online games was approximately 776,000, a 3.7% increase quarter-over-quarter and 9.6% increase year-over-year.

- Monthly average revenue per user (“ARPU”) for online games was approximately RMB246, a 3.5% decrease quarter-over-quarter and relatively flat year-over-year.

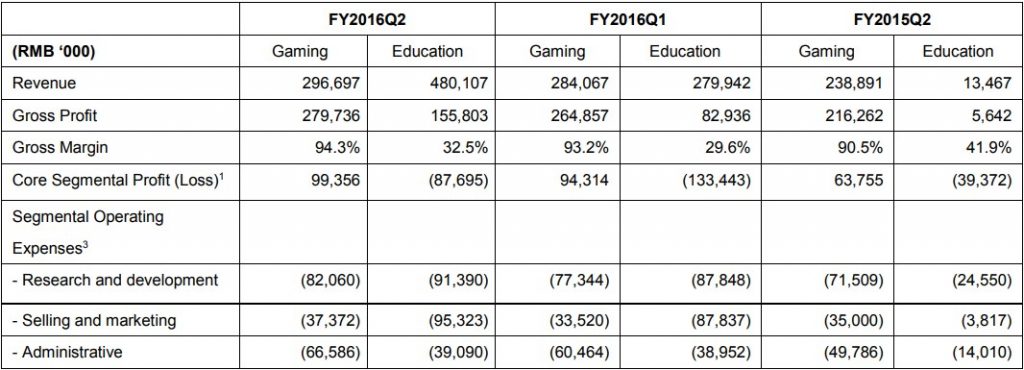

Segmental Financial Highlights

Note 1: Core segmental profit/loss figures are derived from the Company’s reported segmental profit/loss figures (presented in accordance with Hong Kong Financial Reporting Standards) but exclude non-core/operating, non-recurring or unallocated items including government grants, fair value change and finance cost of financial instruments and fair value change of derivative financial instrument and net change on held-for-trading investments. In order to conform to the current period’s presentation, certain comparative figures for prior reporting period have been reclassified.

Note 2: To supplement the consolidated results of the Company prepared in accordance with HKFRSs, the use of certain non-GAAP measures is provided solely to enhance the overall understanding of the Company’s current financial performance. These non-GAAP measures are not expressly permitted measures under HKFRSs and may not be comparable to similarly titled measures for other companies. The non-GAAP financial measures of the Company exclude share-based payments expense, amortisation of intangible assets arising on acquisition of subsidiaries, and fair value change of remeasurement of previously held equity interest in an associate upon acquisition.

Note 3: Segmental operating expenses exclude unallocated expenses/income such as depreciation, amortization and exchange gain/loss that have been grouped into SG&A categories on the Company’s reported consolidated financial statements but cannot be allocated to specific business segments for purpose of calculating the segmental profit/loss figures in accordance with the Hong Kong Financial Reporting Standards.

Mr. Dejian Liu, Chairman and Executive Director of NetDragon, commented: “We are extremely delighted by our achievements in the second quarter where we saw NetDragon achieving a record-high quarterly revenue of RMB786.9 million fuelled by our dual growth engines in games and education businesses.”

“Our online education business had an outstanding quarter as we experienced a remarkable 71.5% quarter-over-quarter growth. In particular, our international online education business grew by 71.1% in the second quarter sequentially, underpinned by our continuous market share gain in the worldwide market during the quarter. Our success in gaining market share is a testament to the broad based acceptance of ClassFlowTM, our game changing cloud-based education software for the international markets.”

“The games business continued to register very strong momentum this quarter with 24.2% increase in revenue and 55.8% increase in core segmental profit year-over-year. Both Eudemons Online PC and pocket versions registered record high monthly revenue or monthly prepaid income during the quarter. Meanwhile, we are getting ready to launch our new games in Calibur of Spirit mobile version and Tiger Knight in the second half of this year. We also have a strong pipeline of new games coming up in 2017, which we believe will propel our games business to a whole new level.”

“Looking forward, we expect to continue the current momentum and reap the rewards from the broad investments we have made into our games and education businesses in terms of research and development efforts as well as mergers and acquisitions that have granted us access to technologies and new markets.”

The Company’s games business continued its growth momentum in the second quarter, with revenue at RMB296.7 million, a 24.2% increase year-over-year. This solid performance was attributable to broad-based revenue growth of our major games. In particular, Eudemons Online and Eudemons Online Pocket version both registered record high monthly revenue or monthly prepaid income during the quarter. Another flagship game, Calibur of Spirit, also continued to further player base, with DAU (daily active users) of 1.8 million in April.

In addition, various operational indicators continued to improve with an increase of 9.6% year-over-year of PCU at approximately 776,000, an increase of 9.1% year-over-year of ACU at 347,000.

Looking into the second half of this year, the Company is excited as we get ready to launch the long-awaited Calibur of Spirit mobile game. We are confident to see substantial revenue contribution from Calibur of Spirit mobile game after its launch. In addition, the Company expects to start generating revenue from Tiger Knight, our new 3D action strategy game, by the end of this year.

Riding on the success of Eudemons Online, the Company plans to launch an App for mobile devices for Eudemons Online during the second half of this year, aiming to provide better protection to users’ accounts and improved user experience, which will help us to further strengthen player retention. The Company will also be launching significant new game-play features and monetization schemes in Calibur of Spirit in next half year which we are confident will drive up monthly gross revenue for this game. Furthermore, the English version of Calibur of Spirit will be launched by the end of 2016, and other languages, including German, French and Russian will also become available subsequently.

To further the Company’s growth of the games business over the mid- to long-run, we have a strong pipeline of new games for 2017, which will leverage our existing game IPs as well as our proprietary technologies and knowhow in gaming. In particular, we expect our Virtual Reality (VR) and Augmented Reality (AR) technologies to play a major role in our upcoming launches of new games. In addition to a robust pipeline, we also expect to leverage the sporting nature of Calibur of Spirit and the immense popularity of this game to create an e-sports online community which will open up to further monetization opportunities in the future.

Education Business

Revenue from the education business of the Company was RMB480.1 million for the second quarter of 2016, a 71.5% increase quarter-over-quarter and over 34 times increase year-over-year. This was largely due to the outstanding performance of our international education business, which recorded a remarkable 71.1% increase in revenue quarter-over-quarter and 45.5% increase year-over-year on a pro forma basis. Promethean, our international education business subsidiary, also recorded an operating profit for the second quarter versus an operating loss in the first quarter, as a result of the increased revenue, improved gross margin and better cost control albeit significant increase of sales activities. ClassFlowTM, the Company’s flagship cloud-based interactive K-12 (Kindergarten-to-Grade 12) software for the international market, continued its growth in user base to nearly 750,000 registered users at the end of second quarter (over 50% increase as compared to March 2016). The Company also continued to take market share as we have grown at a rate of more than 2.8 times the market growth in the K-12 interactive display market during the first half of the year and meanwhile have more than doubled our global market share in K-12 interactive flat panels, demonstrating the success of ClassFlowTM as being the key differentiation factor.

Revenue from the education business in China was RMB26.1 million in the second quarter, a 78.6% increase quarter-over-quarter and 93.5% increase year-over-year. While government funding started flowing in to schools across China starting from the second quarter, we expect such funding will drive significant revenue realization and securing of new sales contracts in the second half of the year for our online education smart classroom ecosystem featuring our flagship 101 Education PPT along with our broad offering of software components that cover pre-class lesson preparation, in-class collaborative lessons, after-school homework system, as well as customizable instant messaging designed specifically for education communities. We expect the bulk of this year’s education revenue in China to be realized in the second half of the year.

The Company continued to make strong progress in the second quarter in its new product development and commercialization. Our VR Editor, our flagship VR classroom application, is scheduled to be launched during the second half of the year. The VR Editor will come with a wide range of “scenarios” and access to what the Company targets to be the largest 3D resource library for VR learning purpose. In terms of AR technologies, the Company has launched AR Wiz, our AR Editor which allows developers to power up applications with fun and engaging AR contents using our proprietary AR technologies. Our joint venture with ARHT Media also made significant tractions in discussions with world-class celebrities and influential speakers to pave the way for the creation of O2O communities using hologram AR technologies. In the international K-12 markets, ClassFlowTM 5.0 was launched during the second quarter. In ClassFlowTM 5.0, marketplace has been extended to provide registered users with access not only to free resources but also to buy and sell resources via the ClassFlowTM platform. ClassFlowTM 5.0 also introduces several new features including ClassFlowTM Community, a discussion forum on educational or pedagogical issues, and Activity Builder that enables different types of activities to be readily inserted into lessons. The ClassFlowTM Moments smartphone app (for iOS and Android devices), which was recently launched, fosters communications between teachers and parents, and is expected to significantly increase user engagement outside of the classroom.

Looking forward, while the Company will continue to invest in the development of our products, we are confident that the product commercialization and revenue growth will continue its momentum into the second half of the year.

Management Conference Call

NetDragon will host a management conference call with PowerPoint presentation and webcast to review its second quarter and interim results ended June 30 on August 31, 2016, at 6 p.m. Hong Kong time. Management attending the conference call includes Simon Leung, Vice Chairman and Executive Director; Ben Yam, Chief Financial Officer.

Details of the live conference call are as follows:

International Toll +65-6713-5090

US Toll Free +1-866-519-4004

Hong Kong Toll Free 800-906-601

China Toll Free (for fixed line users) 800-819-0121

China Toll Free (for mobile users) 400-620-8038

Passcode NetDragon

A live and archived webcast of the conference call will be available on the Investor Relations section of NetDragon’s website at http://www.netdragon.com/investor/ir-webcasts.shtml . Participants in the live webcast should visit the aforementioned website 10 minutes prior to the call, then click on the icon for “2016 Interim Results Conference Call” and follow the registration instructions.

About NetDragon Websoft Holdings Limited

NetDragon Websoft Holdings Limited (HKSE: 0777) is a global leader in building internet communities. Established in 1999, NetDragon is a vertically integrated, cutting-edge R&D powerhouse with a highly successful track record which includes the development of flagship MMORPGs such as Eudemons Online

and Conquer Online, China’s number one online gaming portal, 17173.com, and China’s most influential smartphone app store platform, 91 Wireless, which was sold to Baidu in 2013 in what was at the time the largest Internet M&A transaction in China. Being China’s pioneer in overseas expansion, NetDragon also directly operates a number of game titles in over 10 languages internationally since 2003. In recent years, NetDragon has emerged as a major player in the global online and mobile education space as it works to leverage its mobile Internet technologies and operational know-how to develop a game-changing education ecosystem. For more information, please visit www.netdragon.com.

For investor enquiries, please contact:

NetDragon Websoft Holdings Limited

Ms. Maggie Zhou

Senior Director of Investor Relations

Tel.: +852 2850 7266/ +86 591 8754 3120

Email: maggie@nd.com.cn; ndir@nd.com.cn

Website: www.nd.com.cn/ir