(Hong Kong, 28 August 2019) NetDragon Websoft Holdings Limited (‘NetDragon’ or the ‘Company’;Hong Kong Stock Code: 777), a global leader in building internet communities, today announced its financial results for the first half of 2019. NetDragon’s management team will host an analyst briefing session at 10:00am Hong Kong time at Nathan Room, Lower Lobby in Conrad Hong Kong on 29 August 2019 to discuss the results and recent business developments. Mr. Dejian Liu, Chairman of NetDragon, commented, “We are excited that NetDragon delivered yet another record first half in 2019. Our revenue reached RMB2,672.5 million with 8.2% year-over-year growth, while profit attributable to shareholders more than doubled to RMB421.0 million from RMB200.7 million last year.”

“Our gaming business maintained its strong growth momentum with 51.6% year-over-year revenue growth in the first half. Mobile games revenue jumped by 76.2% year-over-year, while PC games maintained its remarkable growth with 47.5% year-over-year increase in revenue. Our performance in the first half was driven by across-the-board revenue growth coming from all of our major IPs,including Eudemons Online, Heroes Evolved and Conquer Online. We will continue to execute our growth strategy on the back of a strong pipeline and our approach to maximize IP values.”

“Our education business also delivered solid performance as our subsidiary Promethean continued its global market leadership position1 in K-12 interactive classroom technologies with the largest market share in international markets. Our core business2 continued to perform as our shipment volume of interactive flat panels in most of our core regions increased substantially in the first half year-over- year. The large Moscow phase-two tender was a major revenue contributor in second quarter of last year, which led to a year-over-year drop in overall revenue for our education business in the first half. That being said, we are seeing strong traction with our tender business as we see unprecedented volume of tender opportunities in the market, including those in Egypt, Russia and Turkey, and our ability to win these opportunities is stronger than ever. On the product side, we are excited by the commencement of the shipment of our new ActivPanel Elements Series in the second quarter. Customer feedback has been very positive, and its premium model, namely ActivPanel Titanium, was a recent winner of the prestigious Red Dot Design Award. As such, we expect Promethean to see a very strong second half. Last but not least, we are under way to monetize our user base in our online community Edmodo with a SaaS model as we are set to roll out our online tutoring services (AskMo) in the beginning of the upcoming school year.”

“In China, we are starting to execute our go-to-market strategy to start large-scale penetration of our Promethean offerings with a recent major win in Fuzhou. We have also more than doubled the installed base of our flagship platform 101 Education PPT to 6.0 million as at 30 June 2019, and our active coverage with this platform has surpassed over 10 million students. In addition, we are on track to complete the development of our content distribution platform within 101 Education PPT in the second half of this year, which will pave the way for us to start content monetization.”

2019 First Half Financial Highlights

- Revenue was RMB2,672.5 million, representing a 8.2% increase year-over-year.

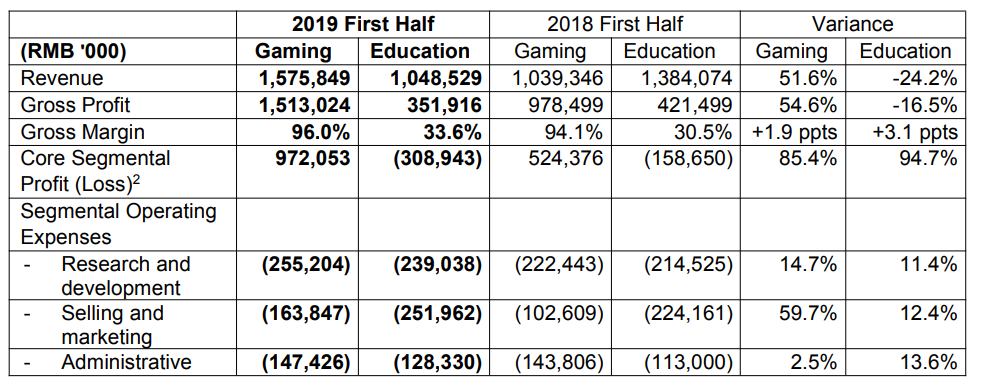

- Revenue from the gaming business was RMB1,575.8 million, representing 59.0% of the Company’s total revenue and registering a 51.6% increase year-over-year.

- Revenue from the education business was RMB1,048.5 million, representing 39.2% of the Company’s total revenue and registering a 24.2% decrease year-over-year. Excluding phase-two of the Moscow order in the second quarter of 2018, revenue from the education business represented a 4.7% increase year-over-year.

- Gross profit was RMB1,865.0 million, representing a 33.0% increase year-over-year.

- Cash inflow from operating activities was RMB420.3 million, compared to cash outflow from operating activities of RMB156.7 million for the same period of last year.

- Core segmental profit3 from the gaming business was RMB972.1 million, representing a 85.4% increase year-over-year.

- Core segmental loss2 from the education business was RMB308.9 million, representing a 94.7% increase year-over-year. The increase was largely due to consolidation of Edmodo for the full 6-month period and seasonality of the Moscow order as noted above.

- Non-GAAP operating profit4 was RMB543.1 million, representing a 117.9% increase year- over-year.

- Profit attributable to owners of the Company was RMB421.0 million, representing a 109.7% increase year-over-year.

- The company declared an interim dividend of HK$0.15 per share for the six months ended 30 June 2019.

Segmental Financial Highlights

1 Based on report issued by Futuresource Consulting dated 12 August 2019, incorporating actual shipment volumes (excluding China) of the Company.

2 Refers to Promethean business excluding selective large tenders

3 Core segmental profit (loss) figures are derived from the Company’s reported segmental profit (loss) figures (presented in accordance with Hong Kong Financial Reporting Standard 8 (“HKFRS 8”) but exclude non-core/operating, non-recurring or unallocated items including government grants, fair value change and finance cost of financial instruments and fair value change of convertible preferred shares.)

4 To supplement the consolidated results of the Company prepared in accordance with Hong Kong Financial Reporting Standards (“HKFRSs”), the use of non-GAAP operating profit (loss) measure is provided solely to enhance the overall understanding of the Company’s current financial performance. The non-GAAP operating profit measure is not expressly permitted measure under HKFRSs and may not be comparable to similarly titled measure for other companies. The non-GAAP operating profit of the Company excludes share-based payments expense, amortisation of intangible assets arising on acquisition of subsidiaries and impairment of goodwill and intangible assets.

Gaming Business

Our gaming business revenue increased by 51.6% year-over-year to RMB1,575.8 million in the first half. Mobile games revenue soared by 76.2% year-over-year, while PC games revenue growth remained robust at 47.5% year-over-year. We also performed well in the overseas markets and recorded 52.1% increase in revenue year-over-year. As a result of strong top line growth and positive operating leverage, gaming business’s core segmental profit surged by 85.4% year-over-year.

In particular, our flagship IP Eudemons recorded 56.5% year-over-year increase in revenue of our PC and mobile version combined. On the back of our marketing activities and new expansion packs, we managed to increase gamers’ loyalty and usage activities, while at the same time optimizing spending. One of the major marketing initiatives we carried out during the period was cross-industry collaboration with renowned celebrities and brands to enhance the market influence of our Eudemons IP in the first half of the year. The result is a revenue growth of our Eudemons IP that goes along with substantial increase in number of our active players as well as paying accounts.

Our other two major IPs, namely Heroes Evolved and Conquer Online, also recorded solid revenue growth of 27.0% and 43.0% year-over-year respectively during the period. Such revenue growth was attributable to our effort in marketing and promotion that has started to pay off. IP crossover collaboration was also a major theme, including a partnership to integrate OVERLORD, a popular Japanese anime, with our Heroes Evolved IP during the first quarter of the year, which led to a significant increase in gross billings. We also significantly stepped up our effort in enhancing the contents and user experience for our players in Conquer Online as we launched a total of 4 expansion packs during the first half.

Looking forward, we will continue to drive revenue and profit growth by maximizing our IP values with new games and new game-play features, as well as expanding our IP portfolio. We have a robust pipeline with over 10 new games under development or in testing stage, including Eudemons II, Heroes Evolved “Thrones”, Battle of Giants, Cyber Legends and Vow of Heroes. We are in a position to launch multiple new games with different genres in the second half of the year, as we see a gradual opening up of new game licensing approvals by regulatory authorities.

Education Business

For the first half of 2019, revenue from the education business was RMB1,048.5 million, down 24.2% year-over-year. Excluding revenue from the large Moscow tender in the second quarter of last year (which we exclude for more comparable presentation as tender revenue tends to be irregular in timing), revenue from the education business represented a 4.7% increase year-over-year. Our subsidiary Promethean continued to perform as shipment volume of our interactive flat panels increased by 28.9% in the first half year-over-year, excluding the Moscow tender as noted above. Our tender business is also seeing strong traction, as the global wave to digitize classrooms and leverage technologies to improve learning has resulted in an unprecedented volume of tender opportunities, especially in several emerging markets such as Egypt, Russia and Turkey. In January of this year, we have signed a MOU with The Ministry of Education of Egypt to design and deliver a total of 265,000 “Pop-up” classrooms with our education products including Promethean panels as well as our software platforms. Taking into account the momentum we are seeing with both our core business and tender opportunities, we expect Promethean to see a strong second half of 2019.

We have also made great progress in product innovation. During the period, Promethean rolled out our next-generation interactive panel, the ActivPanel Elements Series, which is purpose-built to make teaching and learning more effective in a networked learning environment. Specifically, the Element Series will benefit teachers by enabling them to connect with students and use online content and applications to increase learning outcome while keeping students engaged. The result is a platform which provides the foundation for future online monetization at the classroom level. This ground- breaking innovation has earned the Promethean ActivPanel Titanium model a recent winner of the prestigious Red Dot Design Award. The shipment of the AcitvPanel Elements Series commenced in the second quarter and we are seeing great demand going into the second half of the year.

We continue to execute our monetization strategy at the home level, as we are on track to launch our online homework help service within Edmodo in the beginning of the upcoming school year starting in September. We also expect to broaden our tutoring service to online 1-to-1 and 1-to-few video tutoring by the end of this year.

In China, our strategy focus is to both expand user coverage and work towards monetization via a SaaS model. We have started to execute our go-to-market strategy to start large-scale penetration of our Promethean offerings, and we are excited to announce our first major win recently in Fuzhou covering approximately one hundred classrooms. Furthermore, we are continuing to deepen our penetration of our flagship software platform 101 Education PPT with 6.0 million installations as at 30 June 2019 achieving a coverage of over 10 million active students. We are also on track to complete the development of our content distribution platform within 101 Education PPT in the second half of this year, which will pave the way for monetization by enabling consumption of paid value-added contents on the platform. Last but not least, we are seeing a number of school-level SaaS platform opportunities which we are in a strong position to capitalize on given our capability to provide a complete product offering with unparalleled technology and design.

Looking forward, we are optimistic about the outlook as a result of rising traction in tender business, new product shipment as well as online user monetization. We believe our product ifferentiation and leading technologies will enable us to be fulfil our mission to revolutionize education with advanced technologies.

– End –